Explain the Different Types of Bank Advances

The financial and non-financial credit facilities required to the above customers are many. The assets created by borrower out of the loan or credit facility granted by the bank acts as primary security.

Classification Of Bank On The Basis Of Function Qs Study

It is the additional security to cover the loan.

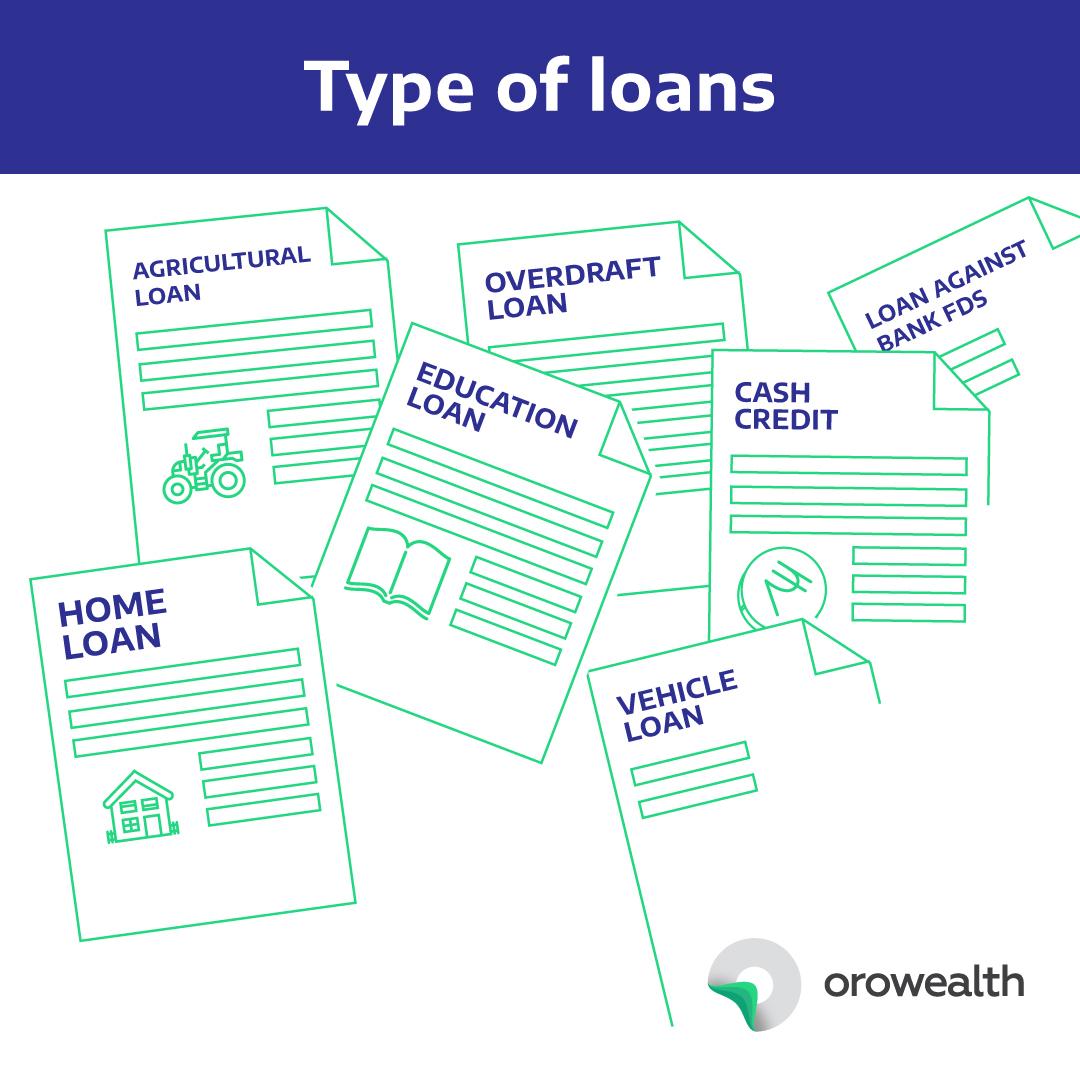

. Barclays Bank of Zimbabwe Limited NMB Bank Limited FBC Bank Limited Banc ABC Limited Formerly ABC Bank Agri-Bank. Cash Credit is a type of advance wherein a banker permits his customer to borrow money upto a particular limit by a bond of credit with one or more securities. Here are different types of loans available in India.

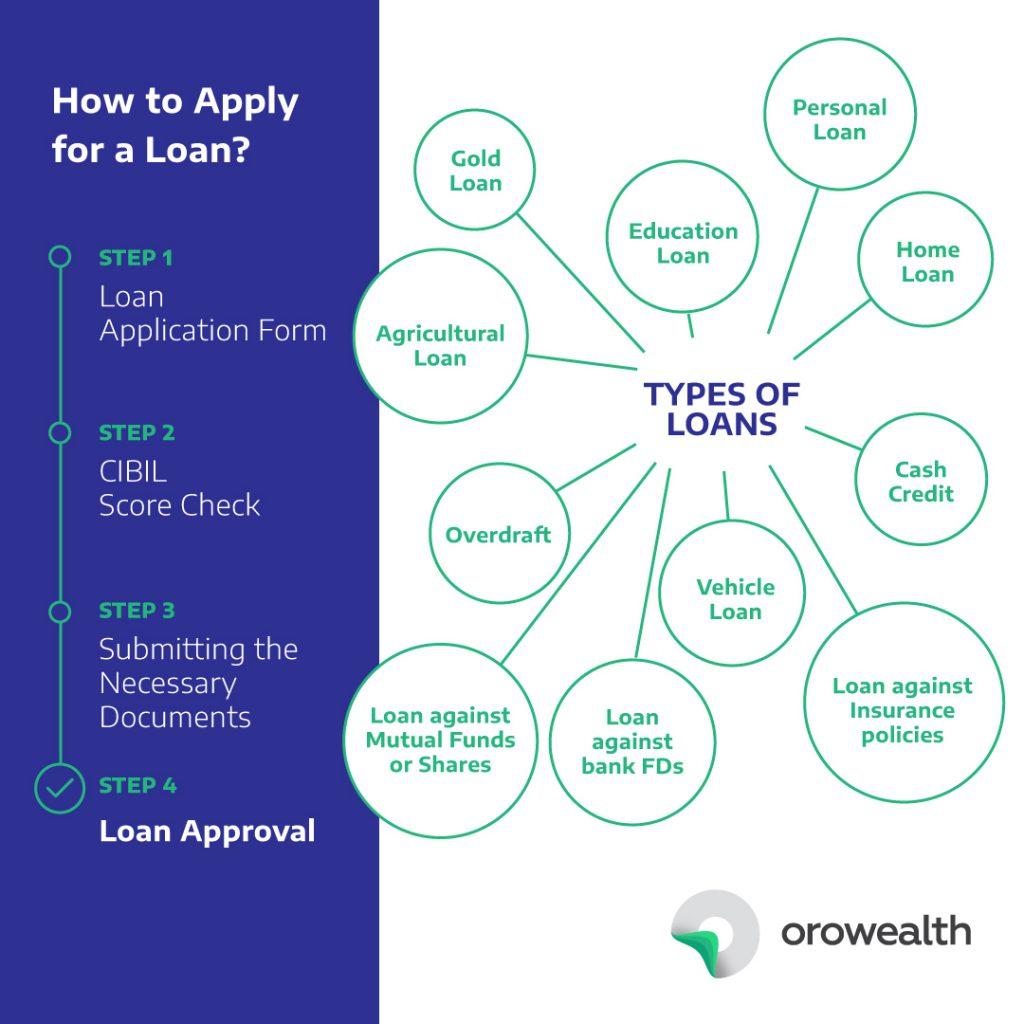

The Different Types of Bank Loans. There are various types of loans available in India and they are classified into two factors based on the purpose they are used for. There are many different types of bank loans each having their own respective purpose.

Different types of bank advance. Agricultural Development Bank of Zimbabwe Ltd Steward Bank EcoBank Limited Zb Bank Limited These are the examples of the types of Commercial banks they are not all listed here just to mention a few. If youre on the hunt for a new checking account or you want to start investing you might need to set aside time in your schedule to do some research.

Sneha Gujar Loans and Advances against various types of Securities. No subsequent debit is ordinarily allowed except by way of interest incidental charges insurance. Public sector Banks A bank where the majority stakes are owned by the Government or the central bank of the country.

Best for paying cash. They may be classified as individuals partnership firms private limited public limited companies large corporate public sector undertakings multinational companies etc. By understanding the different types of banks and their functions youll have a better sense of why theyre important and how they play a role in.

These loans does not require any collateral in the form of security. It can be further divided into personal and impersonal security. Longer-term commercial loans generally secured by real estate or other major assets.

In a demand loan account the entire amount is paid to the debtor at one time either in cash or by transfer to his savings bank or current account. Banks lend money in various forms for various purposes which are given below. Private sector Banks A bank where the majority stakes are owned by a private organization or an individual or a group of people.

The varied types of banking in the spectrum help and satisfy the needs of each sector of the country. EXIM Bank SIDBI and NABARD are examples of such banks. Your credit card may offer a cash advance which is a short-term loan that you borrow against your cards available balance.

Secured and unsecured loans. Providing loans to the public is an important function of banks. There are different types of bank borrowers.

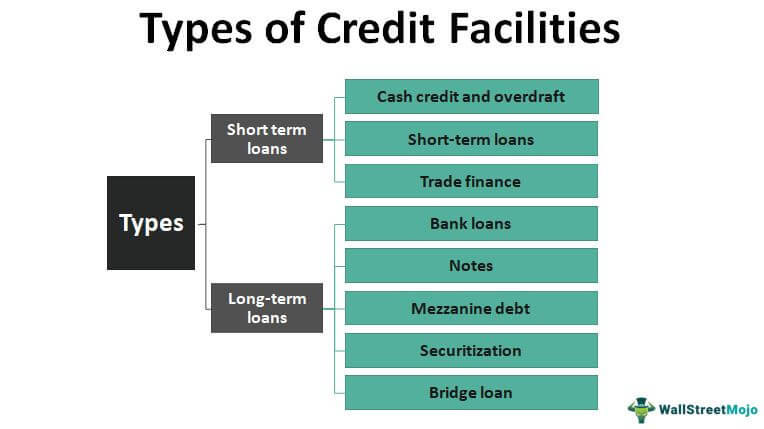

Within in each category of loans there are several different sub-types of bank notes used to make a loan. Loans can be utilised for various things in todays world. All bank loans are categorized into two distinct groupings.

Credit card cash advances. We can divide them in to retail borrowers and. The average interest rate for a 24-month commercial bank loan was 1021 in the fourth quarter of 2019 according to the Federal Reserve.

There are banks for different sectors one bank funds the local entrepreneurs while another bank capitalizes the bug venture capitalist while there are other sets of banks that work for the benefit of the agricultural sector. There are mainly two types of loans and advances provided by commercial banks. Equipment leasing for assets you dont want to purchase outright.

It is the most developed form of credit instrument. -These banks were established in 1975 to enhance the banking facilities in rural areas. The loans that require collateral are the ones where you have to pledge an asset as security for the money you are.

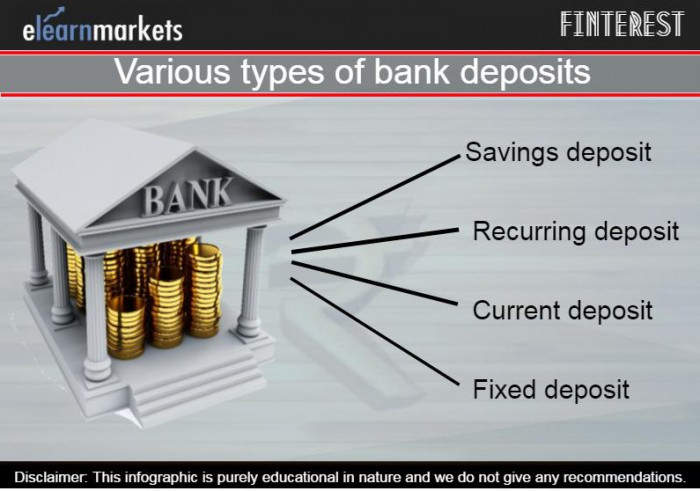

There are several types of deposits which are accepted by the commercial banks like Savings Deposits Current Deposits Fixed Deposits Seasonal Deposits Recurring Deposits etc. It can be used for funding a start-up to buying appliances for your newly purchased house. Explain different types of loans and advances provided by commercial banks.

Advances can be made in the form of overdrafts cash credits term loans etc. -There are some banks that cater to the requirements and provide overall support for setting up a business in specific areas. Thats because there are many kinds of banks and financial institutions.

Not all businesses accept credit cards so if you dont have cash on hand to pay for something you need a cash advance may be a good option. Up to 10 cash back Credit cards a form of higher-interest unsecured revolving credit. 3 Cheque facilities Banks provide cheque facilities to the owners of savings and current accounts to withdraw their money.

Let us talk about the different types of loans available in the market and their specific characteristics that make these loans useful to. The entire amount is given to the borrower at one time Overdraft. A provision by the bank wherein the customer can overdraw money from his her account until a specified cap.

Call loans refers to loans that the lender can demand to be repaid at any time and does not require monthly or quarterly payments. The Commercial banks give different types of loans and advances to the businessmen like Cash Credits Overdrafts Loans Discounting Bills. Short-term commercial loans for one to three years.

Various types of loans and advances given by banks.

Letter Of Credit Credit Advice Ideas Of Credit Advice Creditadvice Advice Letter Of Credit Finance Investing Bookkeeping Business Finance

Why You Should Rethink The Merchant Cash Advance Small Business Loans Business Loans Cash Advance

What Is Commercial Bank Definition Types And Functions Business Jargons

Top 5 Advantages Of A Business Loan Business Loans Business Financial Institutions

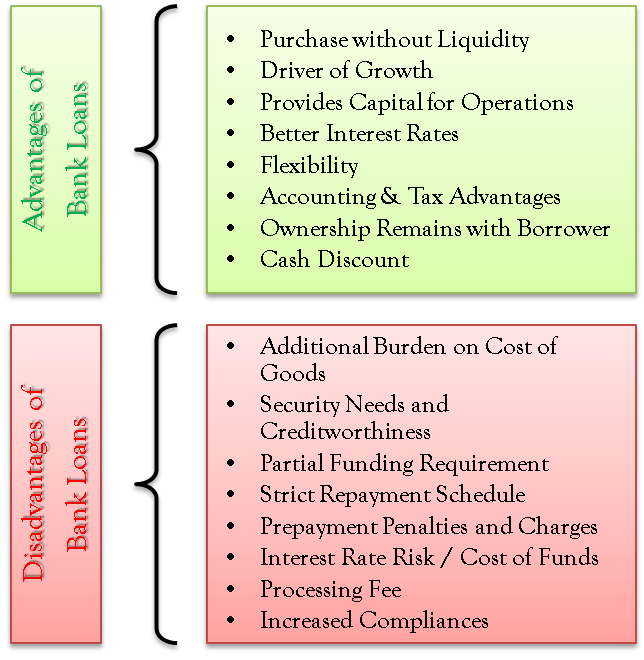

Advantages And Disadvantages Of Bank Loans Efinancemanagement

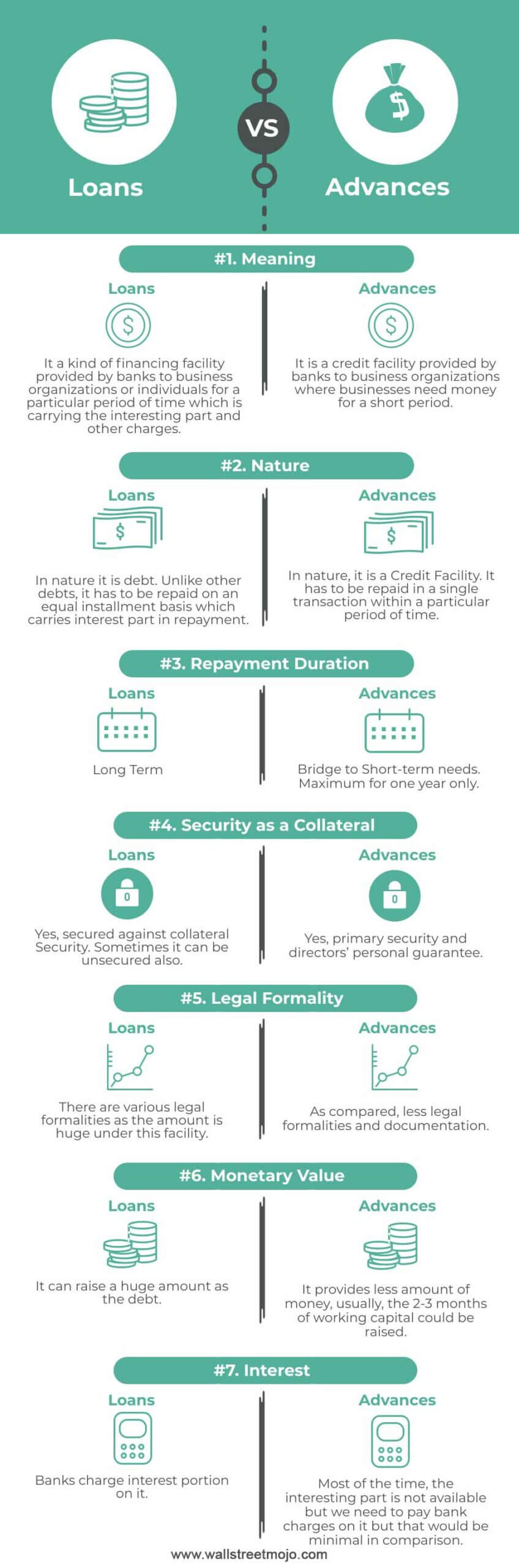

Loans Vs Advances Top 7 Best Differences With Infographics

Different Forms Of Advances By Commercial Banks Loan Types

Various Types Of Bank Deposits Bank Accounts In India

Types Of Loans Personal Loan Home Loan Education Loan Orowealth Blog

Classification Of Loans And Advances Types Of Loans And Advances

Imf World Bank Set Framework Around Fintech Advances Bitcoin Mining What Is Bitcoin Mining Bitcoin

Types Of Adjusting Entries In Accounting Process Accounting Education Accounting Books Accounting Basics

Financial Model For Banking Valuation Excel Banking Investment Banking

Chapter 6 Banking Transactions Ppt Download

Bookkeeping Basics Part 2 What Is Normal A Debit Or A Credit Accounting Basics Accounting Classes Accounting And Finance

Types Of Credit Facilities Short Term And Long Term

Types Of Loans Personal Loan Home Loan Education Loan Orowealth Blog

Comments

Post a Comment